The cryptocurrency landscape has expanded dramatically over the last decade, shifting from an underground financial experiment into a mainstream investment vehicle. As this transformation takes place, one of the most crucial components for users is the cryptocurrency wallet. But crypto wallets are no longer just about storing and transferring digital assets MetaMask. They have evolved to serve a variety of needs, from enhanced security features to decentralized finance (DeFi) interactions and even non-fungible token (NFT) management. Let’s explore the evolving role of crypto wallets and their unique features that cater to a wide range of users.

1. From Simple Storage to Advanced Security

In the early days of cryptocurrency, wallets were simple tools designed to hold a user’s private keys, enabling them to send and receive coins or tokens. These wallets came in two main types: hot wallets (connected to the internet) and cold wallets (offline storage).

As cryptocurrency gained popularity, hackers and scammers began to target wallet users more aggressively, leading to an increased emphasis on security. This prompted the rise of multi-factor authentication (MFA), biometric verification (fingerprint and facial recognition), and hardware wallets, which store keys offline to protect them from online threats.

Unique security innovations like social recovery and multi-signature wallets have further enhanced user control over their funds. Social recovery allows users to designate trusted contacts to help recover a wallet if they lose access, while multi-signature wallets require multiple parties to approve a transaction before it’s executed, making it harder for malicious actors to gain control.

2. Decentralized Finance (DeFi) Integration

A particularly interesting development in crypto wallets has been their integration with DeFi applications. DeFi platforms allow users to lend, borrow, trade, and stake their cryptocurrencies without relying on traditional financial institutions. In the past, using DeFi platforms required third-party services and considerable technical know-how. Now, several crypto wallets have integrated DeFi support, allowing users to interact directly with decentralized applications (dApps).

These wallets often come with built-in features like yield farming, staking, and decentralized exchanges (DEX) access, making them a one-stop-shop for DeFi users. Some popular wallets even offer built-in aggregators that help users find the best rates for staking or lending their assets.

3. NFT Management: The Next Frontier for Wallets

The rise of NFTs (Non-Fungible Tokens) has brought with it a whole new set of requirements for crypto wallets. While NFTs are typically associated with digital art, collectibles, and gaming assets, their utility has begun to extend to sectors like real estate, identity verification, and even ticketing.

Crypto wallets have had to adapt to manage not just cryptocurrencies but also a user’s NFT collection. These wallets now include features to display and organize NFTs, making them easily accessible and tradable. Additionally, certain wallets offer the ability to mint or create NFTs directly within the wallet, further streamlining the user experience.

4. User Experience: Making Wallets More Accessible

Another fascinating trend in crypto wallets is the drive toward making them more user-friendly. Cryptocurrencies have often been criticized for being difficult to understand, and early wallets weren’t much easier to navigate. This has led to a rise in wallet designs that prioritize simplicity, even for those who may not have deep technical knowledge.

Some wallets now include intuitive user interfaces, built-in tutorials, and customer support features. Others are incorporating advanced tools like decentralized identity management and smart contract interactions to offer sophisticated services with a streamlined experience. The goal is to make crypto as accessible as possible for everyone, not just crypto enthusiasts.

5. Cross-Blockchain Wallets: Breaking Down Barriers

One of the challenges in the cryptocurrency space has been the existence of multiple blockchains, each with its own tokens and ecosystem. Historically, wallets supported only one blockchain, making it cumbersome to manage assets across different platforms.

However, modern crypto wallets are breaking these barriers. Multi-chain wallets allow users to store assets from multiple blockchains within the same interface. This eliminates the need for users to juggle multiple wallets and private keys, offering a seamless experience for managing diverse assets like Bitcoin, Ethereum, Solana, and others.

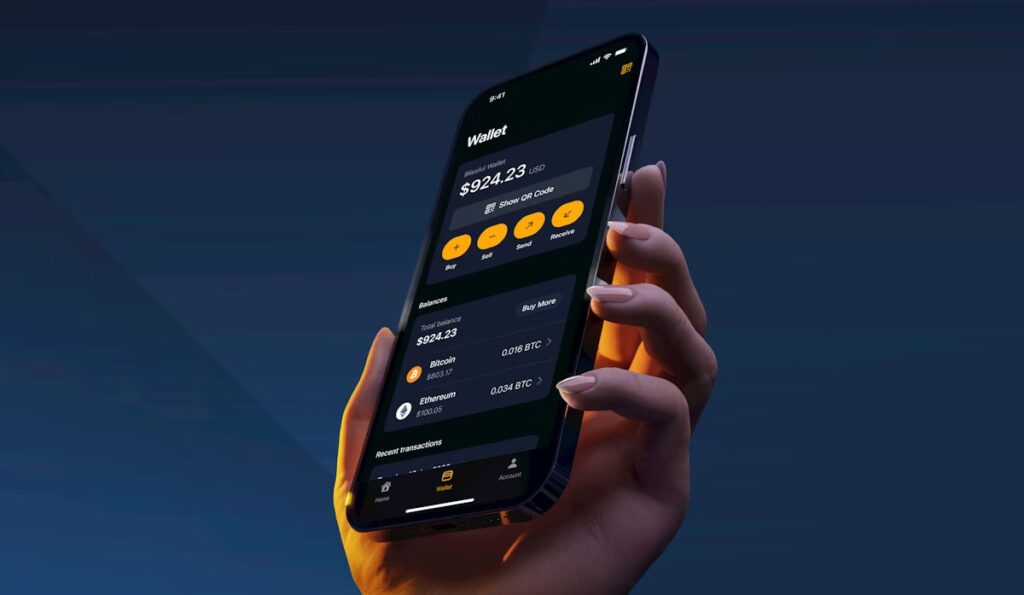

6. The Rise of Mobile-First Wallets

With the increasing adoption of mobile devices, crypto wallets have shifted towards being mobile-first. Mobile wallets offer the same functionality as desktop wallets but with the added advantage of on-the-go access to your assets. They often integrate with mobile apps for enhanced functionality like QR code scanning, enabling quick transactions, and incorporating built-in exchange features to simplify trading.

The mobile-first trend has also led to an increase in custodial wallets, where a third-party service manages the private keys, allowing for a more user-friendly experience. While this may seem less secure than non-custodial wallets, many users prefer the convenience, and some wallets are now offering insurance and backup options to mitigate risks.